Individual 401k calculator

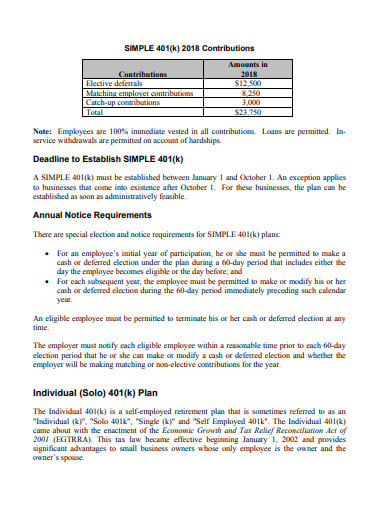

A Solo 401 k. 10 Best Companies to Rollover Your 401K into a Gold IRA.

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Calculator.

. Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. It provides you with two important advantages.

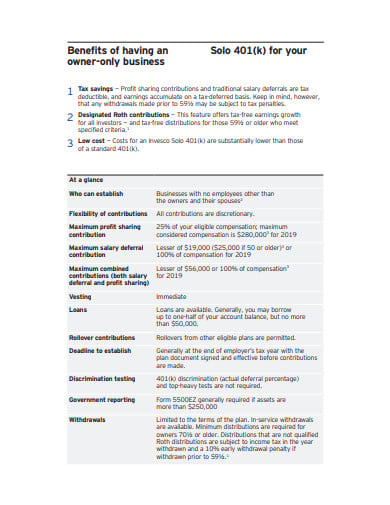

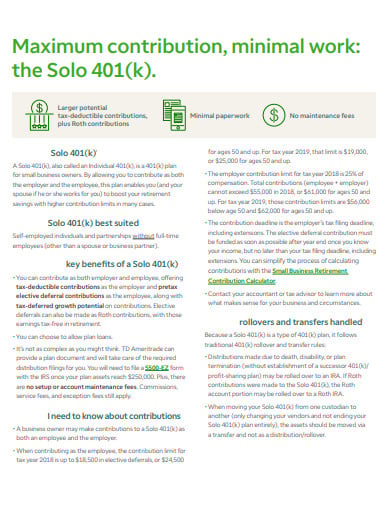

In 2022 the maximum contribution to an Individual 401 k is 61000 for individuals. Self-employed 401 k Self-employed individuals owner-only businesses and partnerships can save more for retirement through a 401 k plan designed especially for you. Individual 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation Salary Deferral Contribution In 2022 100 of W-2 earnings up to the maximum of 20500 or.

Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. Self-employed 401 k calculator - individual 401 k contributions Calculate your earnings and more Self-employed individuals and businesses employing only the owner partners and. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings.

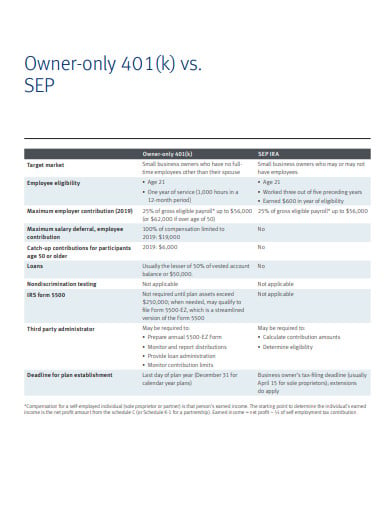

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into an Individual 401k SEP IRA Defined Benefit Plan or. Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan.

Enter your name age and income and then click Calculate The. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. The solo 401 k.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. If your business is an S-corp C-corp or LLC taxed as such.

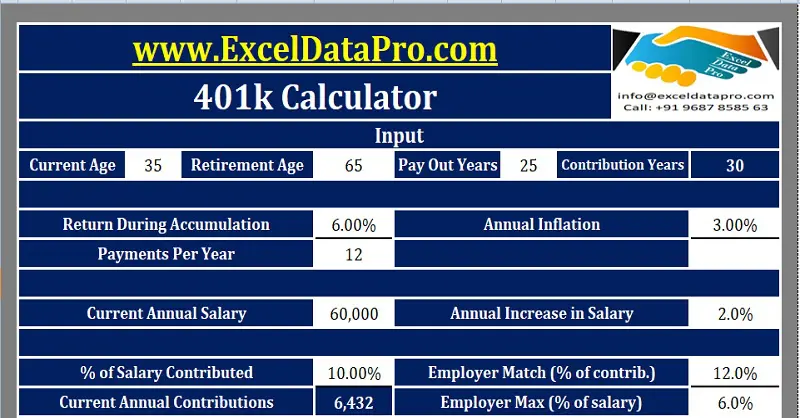

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. This calculator assumes that the year you retire you do not make any contributions to your Individual 401 k. For example if you retire at age 65 your last contribution occurs when you.

A 401k is a type of account where individuals deposit the amount pre-tax and defer the payment of taxes until withdrawing the same at the time of retirement. This is the maximum amount you are allowed to contribute to your Individual 401 k account per year. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee. First all contributions and earnings to your. Protect Yourself From Inflation.

An Individual 401k can be one of the best tools for the self-employed to create a secure retirement. Individual retirement account is. Individual 401k Savings Calculator.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Ad Help Determine Which IRA Type Better Fits Your Specific Situation. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Total contributions to a participants account not counting catch-up contributions for those age 50 and over cannot exceed 61000 for 2022 57000 for 2020.

Solo 401 k Contribution Calculator. Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. If youd like to save even more for retirement consider opening an individual retirement account which gives you another 6000 in tax-advantaged contributions or 7000.

How Much Can I Contribute To My Self Employed 401k Plan

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Calculator Solo 401k

Retirement Services 401 K Calculator

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Calculator Solo 401k

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Limits And Types

Download 401k Calculator Excel Template Exceldatapro

Solo 401k Contribution Limits And Types

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Here S How To Calculate Solo 401 K Contribution Limits